Autonomous highway trucking has moved from science fiction into pilots on U.S. highways. Companies such as Waymo Via, Aurora and Daimler/Torc are running Level‑4 (L4) trucks on dedicated hub‑to‑hub routes in Texas and Arizona dispatchrepublic.com. Analysts project that roughly 13 % of U.S. heavy‑duty trucks could operate autonomously by 2035, with adoption in China and Europe lagging slightly at 11 % and 4 %respectively mckinsey.com. This shift promises safer roads and lower operating costs but is forcing the auto‑insurance industry—an industry built around pricing human risk—to rethink its entire value chain. It creates questions about liability, premium pricing, underwriting, reinsurance capacity and the roles of traditional insurers versus tech‑driven challengers.

This report examines the rise of autonomous highway trucking and its implications for auto‑insurance. It covers adoption trends, evolving risk models, premium pricing strategies, underwriting and reinsurance practices, regulatory catalysts and liability shifts. It also provides scenario analyses reflecting potential geopolitical disruptions and offers strategic recommendations for insurers, investors and policymakers.

Adoption trends and market projections

Technology and adoption timeline

Autonomous trucking is being implemented gradually via hub‑to‑hub L4 operations—self‑driving trucks shuttle trailers between distribution hubs along major highways, while conventional drivers handle first‑ and last‑mile legs. Pilot programs in Texas and Arizona have logged millions of miles, and several companies plan commercial launches by 2025‑2027 dispatchrepublic.com. The Library of Congress notes that fully autonomous trucks, including platoons where only the lead truck has a driver, could appear on highways by 2027, though widespread adoption will be incremental guides.loc.gov.

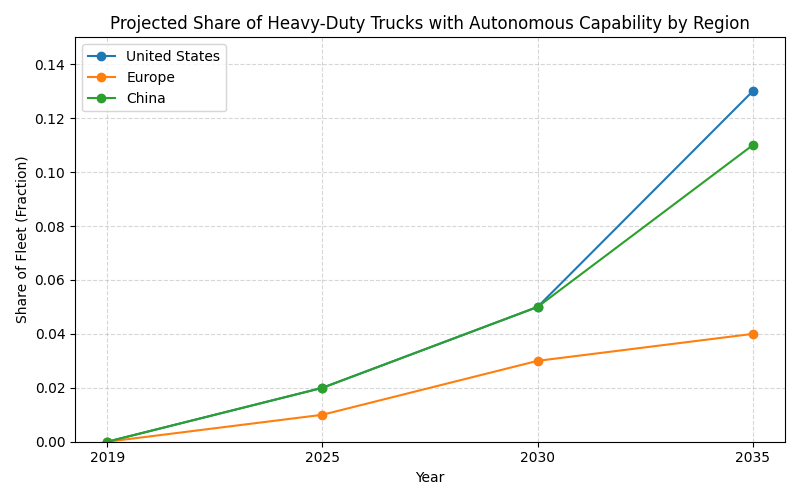

Projections vary across regions. McKinsey estimates that 13 % of U.S. heavy‑duty trucks, 4 % of European trucksand 11 % of Chinese trucks could be autonomous by 2035, generating a global autonomous‑trucking market of ≈$616 billion mckinsey.com. Such growth is driven by acute driver shortages (the U.S. is short roughly 1.2 million drivers over the next decade munichre.com), rising logistics costs and safety improvements (human error causes ~94 % of crashes guides.loc.gov).

The general vehicle market is also evolving. The Insurance Institute for Highway Safety expects 4.5 million self‑driving vehicles on U.S. roads by 2030, though most will have limited autonomy. The Institute of Electrical and Electronics Engineers (IEEE) predicts that 75 % of cars globally could be autonomous by 2040 content.naic.org. Adoption could reduce accidents by almost 90 % by 2050, according to KPMG’s projections content.naic.org. The figure below illustrates projected adoption of heavy‑duty autonomous trucks by region.

Insurance cost projections

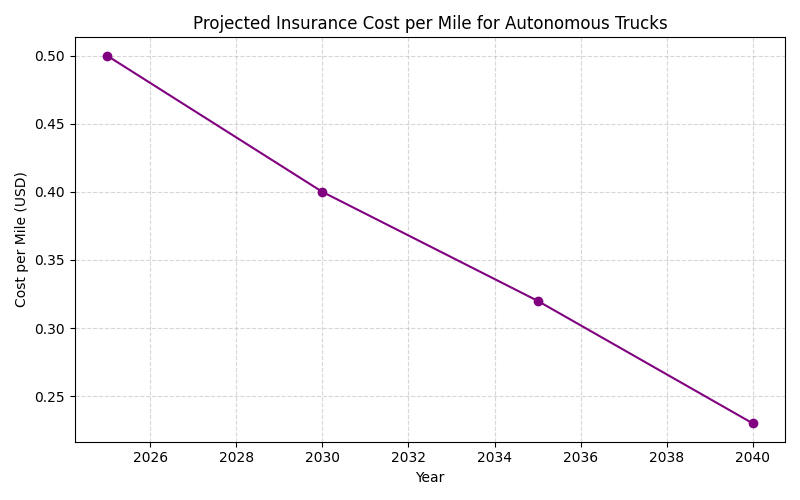

Autonomous technology promises to significantly lower per‑mile insurance costs over the long term. Goldman Sachsanalysts estimate that U.S. insurance costs per mile could decline from about $0.50 in 2025 to $0.23 by 2040, a drop of more than 50 %dispatchrepublic.cominsurancejournal.com. These savings stem from fewer accidents and the removal of human‑related risk. In the near term, however, premiums may rise because vehicles are expensive to repair and exposure to cyber risks increasestruckingdive.com. The following chart shows a conservative projection of insurance cost per mile.

Emerging value pools and market size

While conventional personal‑auto premiums (~$260 billion) are expected to peak and then decline before 2030, McKinsey projects a $100 billion disrupted auto‑insurance space characterized by embedded distribution at vehicle sale points, usage‑based pricing using telematics, and coverages for autonomous and electric vehicles mckinsey.com. The shift from driver‑centric to vehicle‑centric risk pushes insurance spending toward new lines—product liability, cyber coverage, software updates and remote vehicle operations. Insurers and reinsurers who adapt quickly can tap into these new pools.

Evolution of risk models and underwriting practices

From driver‑centric to tech‑centric risk

Traditional motor insurance relies on driver demographics (age, driving record, location) to model loss frequency and severity. Autonomous trucks undermine this paradigm. Swiss Re, collaborating with Waymo, notes that AV adoption will cause a major shift from driver‑centric to vehicle‑centric risk—traditional rating factors become negligible, and lack of claims data compels the development of new risk‑assessment methodologies reinsurancene.ws. Insurers must therefore examine vehicle sensors, software quality, operational design domain (ODD) constraints and near‑miss events rather than human behaviour. munichre.com

Without historical claims experience, underwriters evaluate the safety engineering, redundancy of sensors (LiDAR, radar, cameras), and the extent of remote monitoring. Munich Re’s Leo Grimm explains that insurers currently rely on equipment reviews and near‑miss data to estimate the likelihood of accidents because there is little or no loss history munichre.com. Autonomous trucks operate in narrow ODDs (e.g., specific highways in clear weather) where algorithms perform well, but insurers need to know whether vehicles can handle edge cases. As adoption scales, actuaries must incorporate data feeds from on‑board computers and telematics into pricing models, shifting from static underwriting to continuous risk monitoring.

Premium pricing strategies

Insurers are experimenting with dynamic, usage‑based pricing. According to a Trucking Dive report, some analysts expect premiums to increase initially because of the high cost and complexity of autonomous technology but to decline in the long run as human‑error–related accidents vanish truckingdive.com. Jeremy Vrchota of Cota Systems notes that risk shifts from drivers to tech providers and manufacturers, necessitating new liability models truckingdive.com. Fleets are gathering operational data to negotiate premiums, but Todd Spencer of the Owner‑Operator Independent Drivers Association warns that nuclear verdicts—jury awards exceeding $10 million—have already driven up truck premiums in recent years truckingdive.com.

The use of telematics and crash‑avoidance technologies enables insurers to provide discounts for safer operations. However, a Risk & Insurance article notes that commercial fleets lag behind personal‑auto customers in adopting telematics because insurers rarely offer upfront credits for advanced sensors; some carriers have begun offering usage‑based policies using telematics data, while others (e.g., AXA XL) facilitate partnerships between fleets and telematics providers riskandinsurance.com. Over time, premiums will become more granular—adjusting with each software update or ODD expansion.

Underwriting practice evolution

Underwriting for autonomous trucks will involve new disciplines:

- Systems engineering and software audit: Underwriters must evaluate the software stack, redundancy, cybersecurity and over‑the‑air update processes. Cybersecurity is a growing concern; test scenarios have shown hackers can commandeer autonomous trucks’ braking and acceleration truckingdive.com.

- Product liability assessment: Liability will shift toward manufacturers and technology developers. The RJS Truck Insurance blog emphasises that policies must incorporate product liability coverage to protect against software or hardware failures and that determining fault will require sophisticated investigations rjstruckinsurance.com.

- Mixed‑fleet underwriting: For fleets operating both human‑driven and autonomous trucks, underwriters must assess risk at the fleet level and adjust coverages dynamically rjstruckinsurance.com.

- Claims analytics: Claims frequency should decline, but claim complexity increases because incidents will involve multiple stakeholders (fleet owner, OEM, software provider, cyber insurer). Insurers will require access to sensor logs to reconstruct accidents, raising questions about data ownership and privacy rjstruckinsurance.com.

Reinsurance structures

Autonomous trucking will demand new reinsurance capacity. McKinsey anticipates that as liability shifts to OEMs and system providers, commercial auto premiums could rise, increasing the importance of reinsurers who provide capacity for product and cyber lines mckinsey.com. Traditional reinsurance treaties, which indemnify carriers against catastrophic losses, may be supplemented by parametric covers or structured deals triggered by specific events (e.g., a software recall affecting a fleet). Swiss Re’s collaboration with Waymo aims to standardize risk metrics and share behavioural data, enabling reinsurers to model exposures and tailor coverage reinsurancene.ws. Such data partnershipswill be critical in the absence of claims history.

Adaptation strategies of insurers and insurtechs

Product innovation

Insurers are developing new products tailored to autonomous trucking:

- Embedded and modular insurance: Coverage is embedded at the point of vehicle sale or fleet subscription. Products bundle traditional liability, product liability, cyber protection and business interruption coverage.

- Usage‑based and dynamic premiums: Premiums adjust based on miles driven in autonomous mode, ODD conditions, and software reliability. RJS Truck Insurance suggests dynamic pricing models using real‑time operational data and safety records rjstruckinsurance.com.

- Cyber and software update cover: Policies cover losses from hacks, corrupted updates and system outages, reflecting Aurora’s disclosure that its cyber insurance may be insufficient for large breaches truckingdive.com.

- Mixed‑fleet cover: Flexible policies cover fleets operating both autonomous and human‑driven vehicles, adjusting coverage as the proportion of autonomous vehicles changes rjstruckinsurance.com.

- Parametric insurance: Some insurtechs are exploring index‑based triggers (e.g., payout when a regulatory shutdown occurs or when a fleet’s uptime falls below a threshold due to software issues).

Data partnerships and ecosystem collaboration

The limited loss history of autonomous trucks means insurers and reinsurers must partner with OEMs, tech providers and fleet operators to obtain data. Swiss Re and Waymo are collaborating to study vehicle behaviour and translate it into underwriting inputs reinsurancene.ws. McKinsey advises incumbents to forge partnerships with software‑as‑a‑service (SaaS) companies and telematics providers to build new products and adopt real‑time usage‑based insurance mckinsey.com. Telemetry data sharing must comply with privacy regulations and be standardised across borders.

Strategic responses of incumbents vs insurtech challengers

Traditional insurers such as Progressive and Allstate have experience with usage‑based insurance and are investing in AI‑driven underwriting. Progressive, an early adopter of telematics, is well positioned to transition to autonomous‑system underwriting insurancebusinessmag.com. Incumbent carriers are also forming reinsurance alliances to pool risk and lobby for regulatory clarity. However, they risk being outpaced by insurtechs that specialise in autonomous mobility. Insurtech challengers may offer embedded coverage directly to OEMs or fleets, leveraging advanced analytics and flexible platforms.

Regulatory catalysts and liability shifts

Regulation is fragmented. In the U.S., 42 states and Washington D.C. have enacted AV‑related legislation content.naic.org. The National Highway Traffic Safety Administration (NHTSA) has mandated crash reporting from manufacturers and operators of automated driving systems content.naic.org, but there is no federal liability framework. The United Kingdom’s Automated Vehicles Act 2024 provides one of the most comprehensive AV laws, clarifying responsibilities, establishing safety assurance frameworks and preparing for “self‑driving vehicles” marketinggov.uk. Without international harmonisation, cross‑border trucking faces challenges—vehicles may need to cede control at borders because the Vienna Convention still requires a driver in many jurisdictions munichre.com. Reinsurers warn that multinational fleets must adapt vehicles to local laws, increasing operational complexity.

The shift of liability from drivers to manufacturers and software providers raises fundamental questions. Goldman Sachs notes that the insurance pool will migrate toward product liability and cyber coverage insurancejournal.com. Insurance Business America observes that insurers must move from pricing driver fault to pricing system failure, focusing on software integrity and cyber vulnerability insurancebusinessmag.com. Determining fault in accidents will require analysis of sensor data and code; regulators are still debating whether drivers must remain on standby and who is responsible for remote monitoring. The RJS Truck Insurance blog stresses that claims may involve multi‑party litigation and require specialised investigation and data access rjstruckinsurance.com.

Scenario analysis: geopolitical and macro‑risk considerations

Autonomous trucking does not exist in a vacuum. The following scenarios illustrate how geopolitical factors could shape adoption and insurance dynamics:

| Scenario | Potential Disruption | Insurance Implications |

|---|---|---|

| Cross‑border regulation fragmentation | Countries enforce divergent AV rules. The Vienna Convention still mandates a driver in many jurisdictions munichre.com. Trucks must switch to manual mode when crossing borders, requiring human “escort” drivers. | Mixed‑fleet premiums rise because fleets must maintain human drivers, decreasing the benefits of autonomy. Insurers face jurisdiction‑specific liability laws and must coordinate reinsurance across multiple regimes. |

| Trade restrictions and technology sanctions | Governments impose export controls on AV software and sensors or restrict Chinese or U.S. tech suppliers, similar to current chip tensions. | Supply‑chain disruptions delay deployment of autonomy hardware, lengthening the “chaotic middle.” Higher hardware costs drive up premiums in the short term. Reinsurance treaties may exclude losses related to sanctions. |

| Infrastructure delays and funding shortfalls | Lack of investment in highway sensors, HD mapping and charging/fueling infrastructure slows adoption; extreme weather events and maintenance backlogs degrade ODD reliability. | Autonomous fleets remain confined to limited corridors, reducing economies of scale. Insurers cannot realise projected loss reductions, keeping premiums elevated. Some may offer parametric covers triggered by infrastructure outages. |

| Cyber conflict escalation | Nation‑state cyberattacks target transportation networks, disabling autonomous fleets or corrupting software updates. | Insurers must price systemic cyber risk and may exclude certain warlike cyber events. Demand for cyber reinsurance surges; regulators may mandate minimum cybersecurity standards. |

| Global regulatory harmonisation | Major economies adopt common safety principles (e.g., aligned with the UK’s Automated Vehicles Act) and mutual recognition of AV approvals. | Liability clarity reduces uncertainty and lowers premiums. Standardised data sharing enables reinsurers to model risk globally. Cross‑border fleets become feasible, unlocking growth. |

Recommendations

For insurers and reinsurers

- Invest in technical expertise and data partnerships. Build teams with software engineering, cyber‑security and data‑science skills. Partner with OEMs, telematics providers and reinsurers (e.g., Swiss Re/Waymo collaboration) to collect sensor data and develop new rating factors reinsurancene.ws.

- Develop modular, usage‑based products. Offer embedded coverage at vehicle sale points, combining liability, product and cyber cover with dynamic premiums based on autonomous‑mode usage and software integrity rjstruckinsurance.com. Provide flexible policies for mixed fleets and incorporate parametric triggers for systemic events.

- Enhance cyber risk management. Underwrite cybersecurity separately and monitor vulnerabilities. Require OEMs to comply with security standards; offer incentives for fleets that invest in robust cyber defences and continuous monitoring truckingdive.com.

- Restructure reinsurance. Design treaties that combine product liability, cyber and catastrophic loss coverage. Explore quota‑share arrangements with OEMs and set triggers based on software recalls or system failures mckinsey.com.

- Engage regulators. Work with state and federal authorities to harmonise AV laws and standardise data reporting. Support legislation similar to the UK’s AV Act to clarify liability and promote consumer trust gov.uk.

For investors

- Target ecosystem players. Invest in companies enabling autonomy—L4 software developers, sensor manufacturers, high‑definition mapping firms and telematics providers. These firms will benefit from increased demand for data and safety systems.

- Monitor regulatory milestones. Adoption inflection points hinge on regulatory approval for driverless operation. Align investments with markets where AV legislation is favourable and infrastructure spending is robust.

- Diversify across re/insurance innovators. Allocate capital to insurtech start‑ups offering usage‑based, embedded and parametric products, as well as to incumbents demonstrating tech partnerships and AI‑driven underwriting.

For policymakers

- Create clear, flexible regulatory frameworks. Enact legislation akin to the UK’s Automated Vehicles Act that clarifies liability, sets safety assurance mechanisms and protects marketing terms. Harmonise standards across jurisdictions to enable cross‑border operations.

- Mandate data sharing and privacy protections. Require OEMs and fleets to share sensor data for crash investigations while protecting personal and commercial confidentiality. Encourage open standards so insurers and regulators can access data necessary for risk modelling rjstruckinsurance.com.

- Invest in infrastructure. Fund highway upgrades (lane markings, digital maps, vehicle‑to‑infrastructure communication) and ensure climate‑resilient maintenance to expand the ODD for autonomous trucks. Establish cyber‑security guidelines and rapid‑response units to handle attacks.

- Support workforce transition. Provide training and assistance for displaced drivers, while fostering new jobs in remote fleet operations, vehicle maintenance, cyber‑security and data analytics.

Conclusion

Autonomous highway trucking promises to transform the freight industry, ameliorate driver shortages and improve road safety. However, it also disrupts the foundations of auto‑insurance by shifting risk from drivers to complex systems. Insurers must reinvent risk models, design modular products, harness real‑time data and collaborate across the mobility ecosystem. Reinsurers will play a central role in providing capacity for product, cyber and catastrophic risks, while regulators must craft harmonised frameworks to unlock scale. Success will depend on aligning technology, regulation and insurance innovation to realise the full benefits of autonomy.

Blog: “Highways Gone Robo: How Self‑Driving Semis Will Upend Your Insurance”

Autonomous highway trucking sounds like sci‑fi… until you see a 40‑ton semi cruise down Interstate 10 with nobody at the wheel and only a laptop engineer chilling in the sleeper cab. That future is barreling toward us, and it will reshape auto insurance faster than a runaway Tesla on Autopilot.

Robots at the Wheel (Mostly)

Trucking companies like Waymo Via, Aurora and Daimler/Torc are already running “Level 4” autonomous rigs along hub‑to‑hub routes in Texas and Arizona dispatchrepublic.com. McKinsey predicts that about 13 % of U.S. heavy‑duty trucks will be self‑driving by 2035, while Europe and China will lag slightly at 4 % and 11 % mckinsey.com. The Insurance Institute for Highway Safety estimates roughly 4.5 million self‑driving vehicles on U.S. roads by 2030—although they’ll still need humans for tricky city bits content.naic.org.

Why Insurers Are Suddenly Data Geeks

Traditional auto insurance is all about people—how old you are, how many fender‑benders you’ve racked up, whether you treat your Prius like a go‑kart. Robot trucks flip the script. Swiss Re warns that risk will shift from the driver to the vehicle’s hardware and software reinsurancene.ws. Underwriters now have to inspect LiDAR, radar, GPUs and code updates rather than glancing at a human’s DMV record. Munich Re’s actuaries are literally watching near‑miss videos and reviewing sensor specs because there’s no claims history for AI‑piloted semis munichre.com.

Premiums: Going Down? Going Up? Yes.

Goldman Sachs thinks per‑mile insurance costs will drop from around 50 cents today to 23 cents by 2040 dispatchrepublic.com—cue champagne corks. But hold on: the tech stuffed into these rigs is expensive to repair, and there’s a juicy new cyber risk. Auroral (yes, that’s a verb now) trucks could be hacked and turned into 60‑mph paperweights truckingdive.com. Cota Systems’ CEO expects premiums to rise initially before dropping once we trust the algorithms truckingdive.com. Todd Spencer of the Owner‑Operator Independent Drivers Association says “nuclear verdicts” (those $10 million jury awards) already push premiums up truckingdive.com. So the near term is messy.

Insurers Become Techies—or Dinosaurs

Insurers are rapidly inventing new products:

- Embedded policies that come with your robotruck at purchase.

- Usage‑based coverage that charges per mile and per software version rjstruckinsurance.com.

- Cyber insurance because, yes, a virus crashing your fleet is now as scary as hailstorms.

- Flexible cover for fleets running a mix of human and AI drivers rjstruckinsurance.com.

- Even parametric policies, which pay automatically if your fleet is grounded due to a software recall or regulatory shutdown.

Swiss Re is literally partnering with Waymo to build risk models from scratch reinsurancene.ws. Progressive (remember the “Snapshot” plug‑in?) is well‑placed thanks to its telematics heritage insurancebusinessmag.com. Meanwhile, start‑ups are building platforms that sell insurance like an in‑app purchase for your fleet. Old‑school carriers that don’t get on board may end up like Blockbuster in a Netflix world.

Regulators: Get Your Act Together, Please

Forty‑two U.S. states and D.C. have passed some kind of autonomous‑vehicle law content.naic.org. The UK is ahead with its Automated Vehicles Act 2024, which spells out liability and safety rules gov.uk. In contrast, the Vienna Convention still requires a human driver in many countries munichre.com. That means an autonomous truck may have to park at the Canadian border until a human hops in to steer it over the line. Insurance gets even hairier when different jurisdictions want different data, meaning cross‑border fleets need insurance dictionaries thicker than Tolstoy.

What Could Go Wrong? (A Lot)

Imagine hackers take over a convoy (cyber risk). Or new export controls block Chinese LiDAR sensors (trade restriction). Or Congress underfunds smart highways (infrastructure delay). Or countries fail to harmonize rules, leaving robo‑trucks stranded at customs. Insurers will need new reinsurance structures and parametric triggers to survive such shocks.

Advice for Everyone

Insurers should hire engineers and data scientists, build products that flex with each software update, and team up with OEMs and telematics providers. Investors should look at sensor makers, HD‑mapping firms, and insurtech start‑ups. Policymakers must clarify liability, mandate data sharing (with privacy), and invest in cyber‑resilient infrastructure.

Final Mile

Autonomous highway trucking is no longer a sci‑fi subplot; it’s a live pilot on America’s freeways. The insurance industry must shift from pricing human mishaps to pricing AI failure modes. Expect bumpy roads and comedic regulatory detours. Yet if insurers, technologists and lawmakers learn to ride shotgun together, there’s a future where robotrucks deliver more than goods: they deliver safer roads, lower emissions and, yes, cheaper insurance—eventually.

Enjoy the ride!

Leave a comment